The lockdowns of 2020 may perhaps have prompted consumers to put far more money toward their environment, boosting revenue for dwelling improvement suppliers Lowe’s (NYSE:Minimal) and House Depot (NYSE:Hd), but the financial and housing availability crunches of 2022 are retaining them there.

Home furniture, electronics and home office set-ups aimed at making household a superior location to stay and perform fueled 2020 acquiring, but with individuals going through rising costs of gas and food, theyre heading to house advancement outlets to cope with repairs on their own and get started gardens. This is keeping development at Lowe’s and House Depot robust, generating them both of those potentially financially rewarding portfolio additions this summer months, in my viewpoint.

The two solutions have growing dividend yields, making them attractive for worth buyers looking to make passive earnings as well. Prior to you include either of these household advancement shares to your portfolio, even though, there are some drawbacks to take into consideration.

Lowes

Lowes (NYSE:Very low) is a home advancement retail chain working in the U.S., Canada and Mexico. It features products for development, routine maintenance, repairs and reworking. The housing industry may well be cooling a minor from the highs of 2021, which may possibly inspire initiatives in the property youre in.

Revenues for the organization have doubled above the past ten years, and earnings for each share are envisioned to expand all over 13%. Lowe’s has a dividend generate of 1.66%, and the company has a prolonged monitor history of rising dividends. That could assist sweeten the deal for traders.

Analysts charge Lowe’s a invest in, even while bulls assume the company faces challenges from soaring desire costs, supply chain troubles and flattening housing rates. Its well worth noting that the median age of residences in the U.S. is 39 many years, an age when residences will will need an growing sum of routine maintenance and could be candidates for remodeling.

Lowe’s will get a GF Rating of 96, pushed primarily by prime scores for profiability and development.

House Depot

Surpassing forecasts in 9 of the very last 10 quarters, another major U.S. household enhancement retailer, Dwelling Depot (NYSE:Hd), not long ago described 10.7% progress in net product sales year-in excess of-yr.

Dwelling Depot counts qualified contractors amid its biggest customers, and their big-ticket purchases were up 18% through the previous calendar year. EPS has developed 17% over the past 3 many years and profits is up 8% in excess of the past 12 months, obtaining it a acquire ranking from analysts.

Home Depot has a dividend yield of 2.26%, producing it the a lot more beautiful of these two shares for these in lookup of dividends.

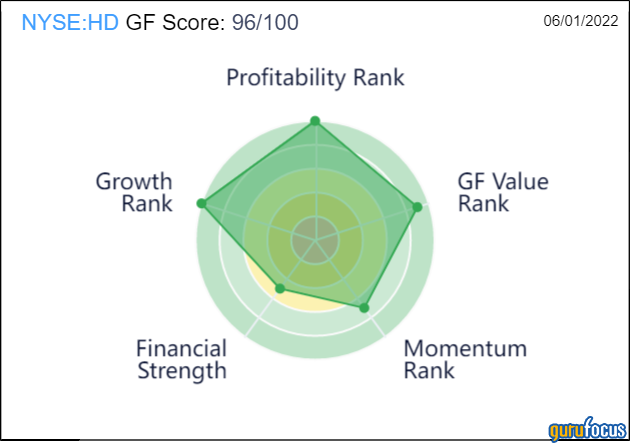

Like Lowe’s, Household Depot also has a GF Rating of of 96/100. In addition to substantial expansion and profitability, it scores improved than Lowe’s for GF Value, however it loses factors for weaker momentum.

This report 1st appeared on GuruFocus.

:max_bytes(150000):strip_icc()/house-cleaning-schedule-for-every-day-3129149-06-b23eacd9ef3a41fc833c68e095b34c72.jpg)

More Stories

Lake Havasu Luxury Resort Bookings

Vail Resorts – 4 Tips to Finding the Best Ski Lodge for Your Money

Calgary Condo Living