NEW JERSEY, UNITED STATES – 2018/02/15: Lowe’s home advancement superstore. (Image by John … [+]

Equally residence advancement merchants in the U.S, Lowe’s (NYSE: Low) and Residence Depot (NYSE: High definition), are using high on the Covid-19 wave as buyers spent additional of their disposable dollars on dwelling advancement tasks fairly than on vacations or dining out. But is Lowe’s inventory correctly priced when compared to Household Depot stock? We feel that Lowe’s stock is extremely undervalued as opposed to High definition inventory, because of to the noteworthy mismatch in their current P/S multiples when in comparison with profits development and operating margins for the two corporations about latest years. Lowe’s P/S several of 1.5x is considerably reduced than the determine of 2.3x for Household Depot.

Lowe’s earnings development over the last twelve months changed by 18.9%, which was bigger than the figure of 13.2% for House Depot. In the course of the same period of time, the functioning margin for Lowe’s transformed by 2.7 share factors, once again much better than the adjust of -.3 share points for Property Depot. Our dashboard Lowe’s vs. Property Depot: Small inventory seems pretty undervalued in comparison to Hd stock specifics the full picture dependent on earnings advancement and working margin – parts of which are summarized beneath.

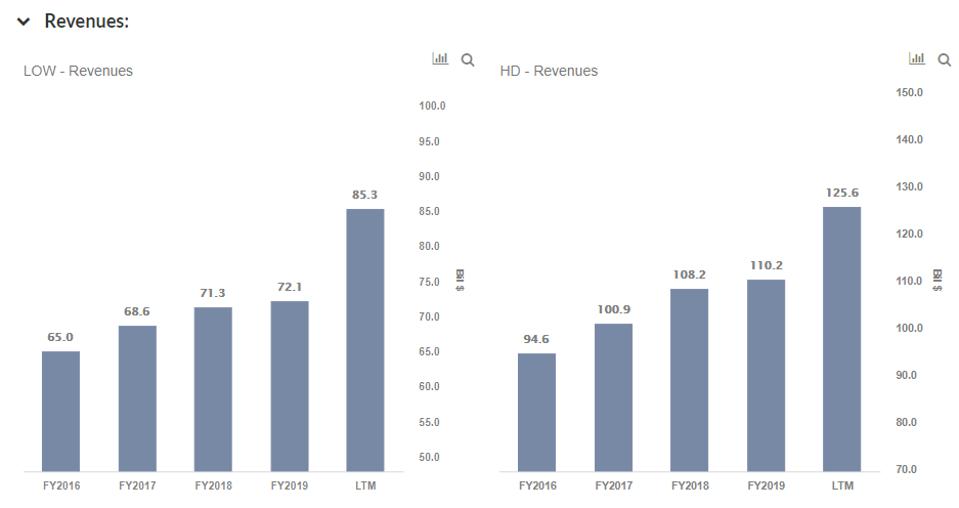

1. Income Growth

When Dwelling Depot nonetheless generates 1.5x a lot more revenues than Lowe’s, the latter’s income development was bigger about the final 12 months in 2020 (19% vs 13% for High definition).

- Of system, the odds of possibly retailer sustaining their current degrees of advancement put up-Covid are slim. But Lowe’s nevertheless has loads of space to expand, supplied its recent e-commerce improvements. Lowe’s Complete House strategy is an encouraging improvement that sets the phase for this probability. The initiative aims to greatly enhance purchaser engagement and grow market place share.

- Going forward, Lowe’s bigger focus on its specialist contractor customers is giving a enhance that could outlast the current house owner demand from customers.

2. Working Cash flow

Coming to working money, Lowe’s experienced a clear edge over Household Depot in the past one year.

- Lowe’s running margin was 8.4% for the most modern twelve-month period of time, which is lessen than Dwelling Depot’s functioning margin of 14.1%

- Around the final twelve months, the operating margin for Lowe’s modified by 2.7 pp (share factors) – improved than the improve of -.3 pp for Property Depot

- In the nine months of fiscal 2020 so much, Lowe’s exact same-shop profits expansion of 26% in the U.S. prompted a 52% 12 months-around-year advancement in working money. Residence Depot’s very same-store profits have been only up 18% for the same interval, prompting a much more modest 14% improve in functioning earnings.

The web of it all

In summary, the net gain moves back again to Lowe’s based on its better earnings advancement and improved working money progress in the latest scenario as in comparison to Household Depot. Whilst House Depot is however a lot more profitable, Lowe’s inventory has performed improved in 2020. Lowe’s and Household Depot trade at an virtually related 2x projected 2021 Revenue. In addition, Lowe’s shares are investing at 17 periods estimated FY 2021 earnings, and Dwelling Depot trades at 22 occasions the identical estimates relative to projected earnings.

Even though Lowe’s inventory is worth looking at, 2020 has developed a lot of pricing discontinuities that can offer you beautiful trading prospects. For example, you will be surprised how counter-intuitive the inventory valuation is for Amazon vs Etsy.

See all Trefis Price Estimates and Download Trefis Details here

What’s driving Trefis? See How It is Powering New Collaboration and What-Ifs For CFOs and Finance Groups | Product or service, R&D, and Promoting Groups

:max_bytes(150000):strip_icc()/house-cleaning-schedule-for-every-day-3129149-06-b23eacd9ef3a41fc833c68e095b34c72.jpg)

More Stories

Tips for Choosing A Legitimate Home Based Business Opportunity

Favorite Hidden Spy Camera For Home Security

Using a Professional Stager to Get Your Home Ready For Sale