Organizations / Investing 2021

Jan 07, 2021 – 03:54 PM GMT

By: Chris_Vermeulen

The ESG theme has taken the funds markets by storm in 2020. Fund flows into this room have been relentless, helping to generate the clean energy sector to new highs. In the initially 50 % of 2020, 23-new trade-traded resources were being introduced below the ESG umbrella. By the conclude of the Q3, ESG index money strike $250 billion in benefit. The ESG umbrella focuses on numerous diverse locations and has flourished through the pandemic. With a vaccine on the horizon, the problem for traders is no matter if this sector will continue being sustainable.

What is ESG and ESG Investing

The term ESG stands for:

- Environmental

- Social

- Governance

The term brings to intellect concepts like local weather improve, variety and inclusion, and source scarcity. While these are types of ESG, it also covers social techniques, including labor and talent management and details stability and item protection. It contains personnel expertise, government fork out, and ethics. There is a vast divide amongst stakeholders on what the time period usually means and how to connect and handle the idea.

ESG investing seems to be a derivative of socially responsible investing (SRI), which has been in existence for decades. Even though gains have constantly been considered the “mothers milk” of stocks, present day traders have realized that shortchanging stakeholders is a substantial value for modern society to pay. A company’s stakeholders contain its personnel, prospects, suppliers, as well as the natural environment, which enjoy a important job in the performing of the corporation.

There is a high-quality line among ESG investing and SRI. ESG investors actively glance for providers that display strong environmental, social, or governance characteristics. SRI focuses on excluding industries that have unsuccessful to reveal compliance in socially responsible areas. ESG provides broader overall flexibility into unique companies’ methods and the various management attributes that make up a company initiative.

Inflows Into ESG Have Been Extraordinary

Inflows to ESG have been strong. ESG ETFs surged to $22 billion in the initial half of 2020, which was far more than 3X the 2019 whole, in accordance to Bloomberg. One of the challenges that regulators facial area is that there is no obvious definition of what constitutes ESG.

The Strategy is Right here to Stay

Some corporate actions clearly show me that ESG is below to keep. Stakeholders at community companies are receiving assurances from administration that their contributions will continue being an vital part of management’s focus. In 2020, Starbucks Corp. declared that the business would mandate antibias instruction for executives and tie their compensation to rising minority illustration in its workforce. Their range and inclusion mandate’s focus on is to have 30% of corporate personnel be minorities by 2025. Although gains at any stage are vital, it’s really hard to imagine that an executive will let their bonus to be eroded by failing to satisfy a corporate ESG mandate.

The Finest Asset Now Course of action

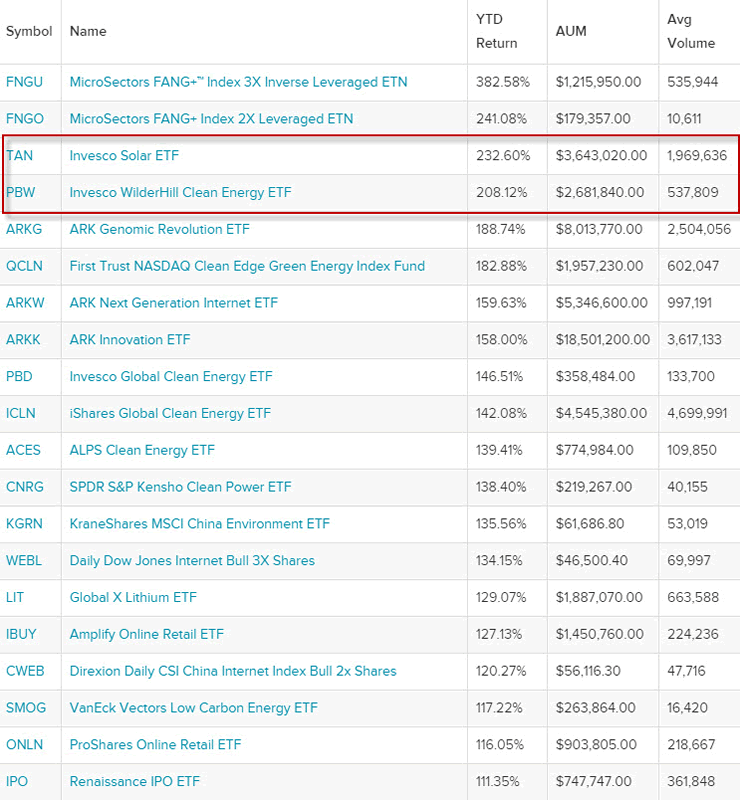

I have pointed out this prior to and I have not wavered. I like to use a BAN method (Very best Asset Now) to come across leading sectors. Two ETFs have mainly outperformed the rest that conforms to the ESG principle. These ETFs depict sectors that have demonstrated leadership and are presently two of the top-5 very best doing ETFs in 2020. These ETFs have created bullish chart patterns that level to a great deal increased costs subsequent their latest breakouts.

There is a purpose to be bullish. President-elect Joe Biden named previous Secretary of Condition John Kerry to direct his administration’s climate improve efforts. Kerry will be the “climate czar” and will be in demand of coordinating programs that are expected to stretch across many companies. This could contain executive orders issued by the new President-Elect to supply avenues beyond Congress to progress weather priorities. This is positive information for clean power ETFs. If you are a stock trader, these are the BAN ETFs to appear at which will outperform.

TAN Hits Refreshing Highs

The Invesco Exchange-Traded Fund Photo voltaic ETF accelerated to multi-calendar year highs in November and is poised to check resistance in the vicinity of the 2011 highs at $91.70. This would include a different 11% to its by now robust 162% return in 2020. Although costs could temporarily consolidate around this $92, a close over this degree would guide to a exam of the 2010 highs at $115. A shut above $115 could direct to a take a look at of the all-time highs in close proximity to $307. Momentum is favourable as the MACD (going regular convergence divergence) histogram is printing in good territory with an upward sloping trajectory which points to better costs.

PBW Invesco Exchange-Traded Wilderhill Clean up Vitality ETF

Has broken out and is poised to check the 2008 highs in close proximity to $119.50. Help is found in the vicinity of the 10-week shifting average of $71.70. Momentum is optimistic as the MACD (shifting average convergence divergence) histogram is printing in favourable territory with an upward sloping trajectory, which factors to increased prices.

Be certain to sign up for our absolutely free current market trend analysis and signals now so you really don’t miss out on our upcoming particular report!

Do you want to continue to be ahead of these sector traits and find out which sectors are the best chances for your trades? Our BAN Trader trades the Ideal Asset Now making use of to continually earn greater-than-current market returns. Learn how our BAN Trader option can support you maintain centered on the very best investing opportunities in 2021 and over and above whilst aiding you shield and improve your prosperity. Go to www.TheTechnicalTraders.com to discover more about BAN Trader, or let me educate you how to trade this strategy on your own by looking at my Free webinar! Scroll underneath to sign-up for your seat now and make 2021 your yr to Financial gain!!

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been concerned in the markets considering that 1997 and is the founder of Technical Traders Ltd. He is an internationally regarded complex analyst, trader, and is the creator of the book: 7 Methods to Get With Logic

By means of yrs of study, buying and selling and encouraging person traders close to the world. He acquired that many traders have terrific investing strategies, but they lack one particular issue, they wrestle to execute trades in a systematic way for dependable effects. Chris will help educate traders with a a few-hour online video course that can change your trading success for the superior.

His mission is to help his consumers enhance their trading effectiveness whilst decreasing current market publicity and portfolio volatility.

He is a normal speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio demonstrates. Chris was also featured on the address of AmalgaTrader Journal, and contributes articles or blog posts to several top fiscal hubs like MarketOracle.co.uk

Disclaimer: Almost nothing in this report ought to be construed as a solicitation to obtain or provide any securities talked about. Technical Traders Ltd., its owners and the author of this report are not registered broker-sellers or fiscal advisors. Ahead of investing in any securities, you should really talk to with your monetary advisor and a registered broker-supplier. By no means make an expenditure dependent solely on what you read in an on the net or printed report, which include this report, primarily if the investment consists of a compact, thinly-traded enterprise that isn’t effectively identified. Complex Traders Ltd. and the creator of this report has been paid by Cardiff Vitality Corp. In addition, the author owns shares of Cardiff Vitality Corp. and would also advantage from volume and cost appreciation of its inventory. The details offered below within really should not be construed as a monetary assessment but instead as an ad. The author’s sights and views concerning the firms showcased in reviews are his personal views and are centered on details that he has researched independently and has obtained, which the creator assumes to be trustworthy. Specialized Traders Ltd. and the creator of this report do not promise the accuracy, completeness, or usefulness of any material of this report, nor its exercise for any unique goal. Last of all, the writer does not assure that any of the providers described in the studies will perform as predicted, and any comparisons made to other firms may possibly not be valid or appear into effect.

© 2005-2019 http://www.MarketOracle.co.uk – The Industry Oracle is a No cost Each day Economical Markets Evaluation & Forecasting online publication.

:max_bytes(150000):strip_icc()/house-cleaning-schedule-for-every-day-3129149-06-b23eacd9ef3a41fc833c68e095b34c72.jpg)

More Stories

Living Room Trends 2023 To Jazz Up Your Home

David Selinger, CEO of Deep Sentinel

How to prepare your home for a cat